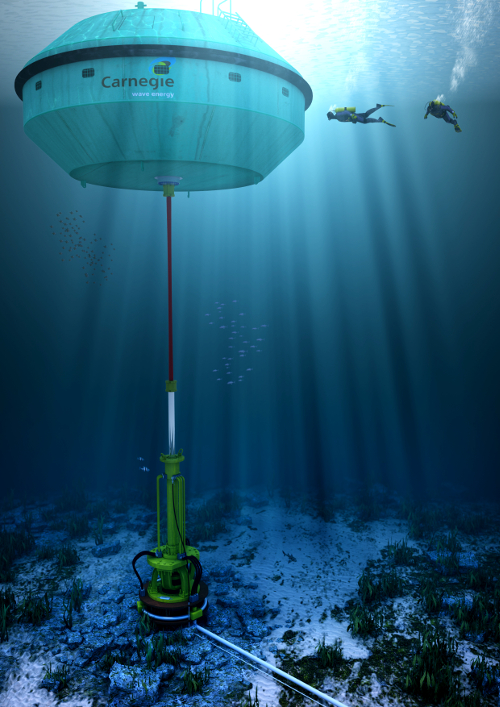

Carnegie clawing back

Embattled wave power company Carnegie Clean Energy has had its shares reinstated to the ASX.

Embattled wave power company Carnegie Clean Energy has had its shares reinstated to the ASX.

The company made a last-ditch bid to avoid liquidation by raising a minimum of $5.5 million, by reaching out to companies associated with former AFL commissioner Mike Fitzpatrick and his fellow Carnegie directors.

Carnegie went into administration in March, after the WA Government cancelled a $16 million contract to build Australia's first commercial wave farm.

The company’s chair Terry Stinson has described the recapitalisation and return to trading as a “rebirth”.

Mr Stinson said “coming back from the brink” taught Carnegie's management some “painful but important lessons”.

“Carnegie's culture change extends to how we will do business in the future, where the business will live and how carefully we will spend shareholder funds,” he said.

The company has raised more than $200 million from investors and governments in the last 15 years developing its technology, including tens of millions of dollars in state and federal government grants and tax breaks.

However, it has never turned a profit, and posted a $52 million loss for past financial year, following a $63 million loss the previous year.

The financial problems have been linked in part to Carnegie’s acquisition of solar microgrid company Energy Made Clean in 2016, and difficulty of trying to compete with cheaper and far more established solar and wind energy.

Carnegie’s annual report says it will abandon a capital-hungry strategy of building wave energy hardware, and try to license its technology out to other renewable energy firms instead.

Mr Stinson says the company has enough cash to last until 2021.

“During that time, the team will be working on additional sources of non-debt funding and working hard to avoid the need to come back to shareholders for further funds, however to be transparent, future shareholder funding may be required to realise our full and longer-term potential,” he said.

Print

Print