Fossils feeling green pinch, move to slice services

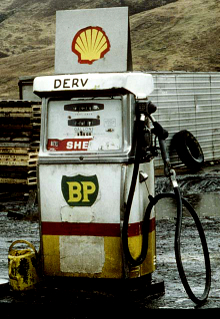

Reports this week claim two giants of the petrol game are looking to sell their Australian refineries and petrol stations.

Reports this week claim two giants of the petrol game are looking to sell their Australian refineries and petrol stations.

The move would prompt a massive shake-up in the $50 billion Australian petroleum sector. The claims stem from a report in local financial media, which suggests big energy players Royal Dutch Shell and BP may be looking to generate new funds for the central energy production efforts.

Insiders allege that Shell has been in talks with a private equity firm and a consortium of investment banks over what could be the $3 billion sale of its refinery in Geelong and about 900 petrol stations.

The closest thing to official word came last November, when Shell chief executive Peter Voster said the company was “entering into a divestment phase” to find better avenues for expenditure amid rising costs.

The same reports say BP has been eyeing-off a $3 billion sale of petrol stations and refineries across Queensland and Western Australia. Currently the company owns around 225 stations, but supplies fuel to around 1400. BP's local petrol retailer and distributor Ausfuel has already been moved to market, with private equity firm Archer Capital kicking-off the $625 million-plus sale last year.

Australian service stations have been in steady decline since the 1970s, dropping from 20,000 outlets nationwide to just 6,300 in 2011. Its refineries are growing stale too, with several Australian sites unable to deal with new capacities, challenged by renewable sources and earmarked for overhaul.

The industry rumour-mill has thrown up Caltex, Liberty Oil, Neumann Petroleum, 7-Eleven and Freedom Fuels as likely trader candidates to bid, as well as some superannuation and investment funds.

Print

Print